Financial Stability Step by Step

10 Habits That Make You Financially Stable

Financial stability is not achieved overnight — it comes through small habits that become part of your routine. Regularly analyzing your expenses and avoiding impulsive purchases is essential. Even setting aside a small amount each month helps build savings. Planning large expenses prevents falling into debt traps. Tracking income and spending ensures control, while comparing prices and seeking better deals allows you to save. Financial discipline, avoiding unnecessary loans, and continuous learning are the foundation of long-term confidence and security.

Emergency Fund: Why You Need It and How to Build It

An emergency fund is a financial cushion that protects you from unexpected situations such as job loss, illness, or urgent repairs. Experts recommend saving the equivalent of 3–6 months of expenses. You can start small by setting aside 5–10% of your income into a separate account or e-wallet. The money should be easily accessible but not used for daily spending. This reserve lowers stress and helps you make decisions calmly. Having an emergency fund provides stability and supports progress toward long-term financial goals.

Modern Approaches to Personal Budgeting: From Excel to Apps

In the past, people tracked expenses with notebooks or Excel spreadsheets. Today, it’s much easier — dozens of apps automatically analyze your spending and generate reports. They sync with bank cards, send payment reminders, and categorize expenses. Still, the choice depends on your habits: some prefer the control of manual Excel tracking, while others enjoy mobile apps with charts and automation. The key is consistency — recording income and expenses regularly. Modern tools make it easier to manage money, save time, and avoid chaos in personal finances.

Mistakes That Prevent You From Saving Money Every Month

Many people want to start saving but face the same recurring mistakes. The first is saving only what’s “left over” after expenses — which often means nothing gets saved. The second mistake is not having a clear goal: it’s much harder to save “just in case” than for a vacation or a purchase. Another common issue is not tracking expenses — small, daily costs can quietly consume a large portion of your budget. A further problem is relying on credit instead of building savings. To avoid these mistakes, set aside money right after receiving income and review your spending regularly.

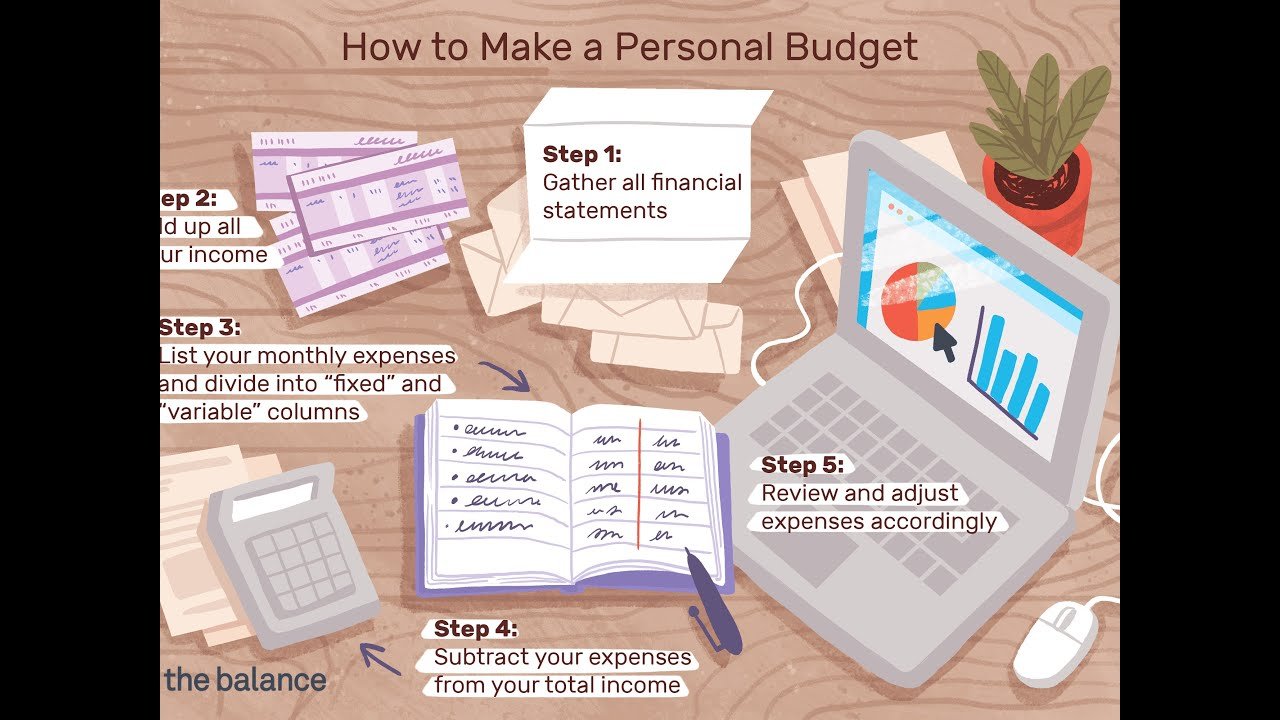

Personal Financial Plan: How to Create It and Stick to It

A financial plan helps you see the bigger picture of your income, expenses, and future goals. Start by setting short-term and long-term objectives: for example, building an emergency fund, saving for education, or buying a home. Next, list your income sources and expense categories, and allocate a fixed amount for savings. It’s important to make the plan realistic and suited to your lifestyle. To stay consistent, use tools like budgeting apps or spreadsheets that remind you of your goals. Regularly reviewing and adjusting the plan will keep it relevant and help turn it into a sustainable habit.

Why It’s Important to Have Multiple Sources of Income

Relying on just one source of income is risky: losing a job or facing a salary cut immediately affects financial stability. Additional income streams help spread the risk and provide greater confidence. These can include side jobs, investments, freelancing, or even a small personal project. Even a modest extra income accelerates savings and helps you reach your goals faster. Moreover, diversification increases flexibility — during a crisis, one stream can compensate for temporary difficulties with another. This approach makes your budget more resilient and less dependent on external circumstances.

Investments for Beginners: How to Start Without Fear

Many people delay investing because they’re afraid of losing money, but it’s possible to start gradually and safely. The first step is to understand basic instruments: deposits, bonds, and index funds. These carry lower risks and help you learn how the market works. It’s important to invest only the amount you’re comfortable setting aside for the long term and not to chase quick profits. Diversification is also key: don’t put everything into one asset. Begin with small amounts and regularly study educational materials. This approach allows you to take your first steps calmly and without unnecessary stress.

Smart Strategies for Long-Term Financial Goals

How to Save for an Apartment: Strategies for Ordinary People

Even with an average income, it’s possible to save for an apartment if you approach it systematically. The first step is to set a clear goal: the cost of the property and the timeframe in which you want to reach it. Next, open a separate savings account or deposit and regularly set aside a fixed percentage of your income. Cutting unnecessary expenses and redirecting those funds toward savings is key. Consider moderate-risk investments, such as bonds or index funds, to protect your money from inflation. Discipline and consistency will gradually turn the dream of homeownership into reality.

How to Get Rid of Debts and Loans: Step-by-Step Plan

The first step to becoming debt-free is to acknowledge all debts and make a complete list with interest rates and due dates. Then, choose a repayment strategy: either paying off the smallest debts first (the “snowball method”) or the most expensive ones in terms of interest. Cut unnecessary expenses and direct those savings toward repayment. Negotiating with the bank for restructuring can also ease the burden. Most importantly, avoid taking on new loans during this period. By following a clear plan, you can gradually get out of debt and regain control over your finances.

How to Plan for Retirement Today

Retirement may seem far away, but early planning ensures a more comfortable future. Start by calculating how much money you’ll need to live after retirement. Then, set aside a small percentage of your income into pension programs, insurance products, or long-term investments. Even modest, consistent contributions can grow significantly over time thanks to compound interest. Diversify your savings and review your plan every few years. Preparing for retirement today reduces financial risks later and gives you confidence about the years ahead.

Essential Tools and Knowledge for Smarter Money Management

Essential Tools and Knowledge for Smarter Money Management

In 2025, financial apps have become smarter and more convenient than ever. They automatically gather expense data from cards and banks, generate detailed reports, and even offer personalized saving tips. Among the most popular tools are apps that categorize spending, send payment reminders, and forecast upcoming expenses. Some now use artificial intelligence to analyze habits and help users reach goals faster. When choosing, it’s important to consider not only functionality but also ease of use. A digital assistant like this saves time and reduces the risk of financial mistakes.

7 Ways to Protect Your Money From Scammers

Scammers are getting more creative every year, which makes financial protection a crucial part of money management. First, always use strong passwords and two-factor authentication. Second, carefully check links and email senders to avoid phishing attempts. Never share your card details with strangers. For online purchases, it’s best to use a separate card with a limited balance. Enabling transaction notifications and regularly reviewing statements adds another layer of safety. Finally, avoid storing sensitive data on public devices. These simple steps can significantly reduce risks and safeguard your savings from cyber threats.

Top 7 Books That Will Change the Way You See Money

Books on personal finance can reshape your mindset about money and build practical skills. Classics like Rich Dad Poor Dad by Robert Kiyosaki teach financial thinking, while George Clason’s The Richest Man in Babylon emphasizes the value of saving. Modern authors also cover psychology of money, habits, and beginner-friendly investing. These books provide both practical advice and motivation to make changes. Reading them helps broaden your perspective, avoid common mistakes, and make more informed financial decisions.

Building a Healthy Money Mindset

How to Build Healthy Financial Habits in 30 Days

It’s possible to form new habits in just a month if you act consistently. Start small: record every expense, even the smallest ones. Next, set aside a fixed amount for savings immediately after receiving income. Avoid impulsive purchases by giving yourself 24 hours to think before buying. Use reminders and budgeting apps to stay on track. Within 30 days, these steps turn into a sustainable system that helps you keep control over your money and steadily move toward larger financial goals.

Minimalism and Money: How Simplifying Life Affects Your Budget

Minimalism is not only about decluttering but also about managing money. By avoiding unnecessary purchases and focusing on what truly matters, you can reduce expenses and save faster for meaningful goals. This simplified approach helps you stay out of debt and lowers financial stress. Minimalism teaches you to analyze each expense and understand its real value. In the end, you not only save money but also realize that many purchases don’t bring long-term satisfaction. This lifestyle frees up resources for investments, travel, or other priorities.

Financial Literacy and the Psychology of Money: How They’re Connected

Financial decisions are often driven not by knowledge but by emotions and habits. The psychology of money explains why we make impulsive purchases or postpone planning. Understanding your own beliefs helps you change behavior and build healthy habits: saving, investing, and avoiding unnecessary debt. Financial literacy provides the tools, while psychology offers the motivation to apply them. Together, they create a strong relationship with money, allowing you to make rational choices and build long-term financial stability.

How Money Affects Relationships: Family Budget Without Conflicts

Finances in a family often become a source of arguments, especially when partners have different views on spending and saving. To avoid conflicts, it’s important to keep the budget transparent: discuss income, record expenses, and set financial goals together. It’s useful to separate common expenses from personal ones so that each partner maintains a sense of independence. Regular conversations about money help reduce tension and build trust. This approach turns the family budget into a tool for joint growth rather than a cause of misunderstanding.

Financial Literacy for Children: Simple Lessons for Parents

The earlier a child learns the value of money, the more confident they will be in the future. Parents can explain the basics through simple examples: pocket money, a piggy bank, or shared shopping. It’s important to show that money is not unlimited and to teach saving for desired items. Games and practical tasks make learning easier and more engaging. Most importantly, parents should lead by example: if they plan and save effectively, children adopt those habits. Financial literacy taught in childhood builds responsible money management and reduces mistakes in adult life.