How to Protect Your Personal Finances in the Digital World: 3 Simple Steps

Step 1. Use only trusted services and apps

Before linking your card or e-wallet to a new service, make sure it’s reliable. Check the website: look for HTTPS, licenses, and official contact details. Download apps only from the App Store or Google Play, not from third-party links.

Step 2. Set up multi-level account protection

Strong passwords and two-factor authentication are the basic minimum. Use different combinations for banking apps, e-wallets, and email. A password manager will help you store all credentials securely in encrypted form.

Step 3. Monitor your transactions and notifications

Enable SMS or push alerts for all operations. This way, you’ll immediately spot suspicious activity. Regularly review bank statements and online banking history to block fraudulent charges in time.

Key Tools for Protecting Your Finances Online

Online Payment Security: What Everyone Should Know

When making online payments, always check the security of the website. Look for the padlock icon in the address bar and make sure the link starts with https://. Avoid saving card details on shared devices and don’t use public Wi-Fi for transactions.

It’s also a good idea to enable payment limits or virtual cards. They add an extra layer of control and reduce the risk of losing large sums if data is compromised.

Financial Scammers: The Most Common Schemes in 2025

Fraudsters adapt quickly, and in 2025 the most common schemes are phishing emails, fake investment platforms, and calls from “bank representatives.” Criminals use convincing language and professional-looking websites to steal credentials and money.

To protect yourself, never share login codes, PINs, or personal details over the phone or email. If in doubt, contact your bank directly using the number on the official website, not the one given by the caller.

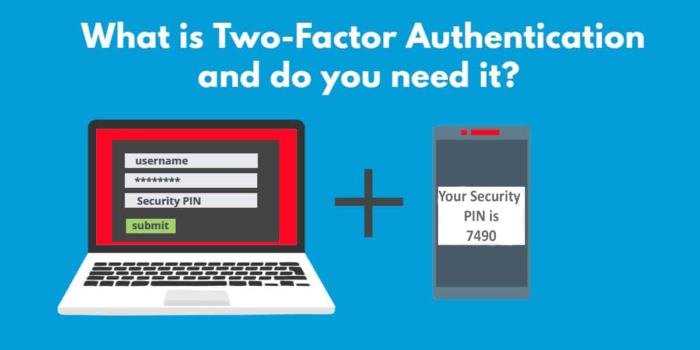

Two-Factor Authentication: Why Your Money Needs It

Two-factor authentication (2FA) is one of the simplest ways to strengthen your financial security. In addition to a password, you confirm each login or transaction with a one-time code sent by SMS, email, or an authenticator app.

This makes it much harder for criminals to gain access, even if they somehow learn your password. Enabling 2FA in all financial apps significantly reduces the risk of unauthorized access.

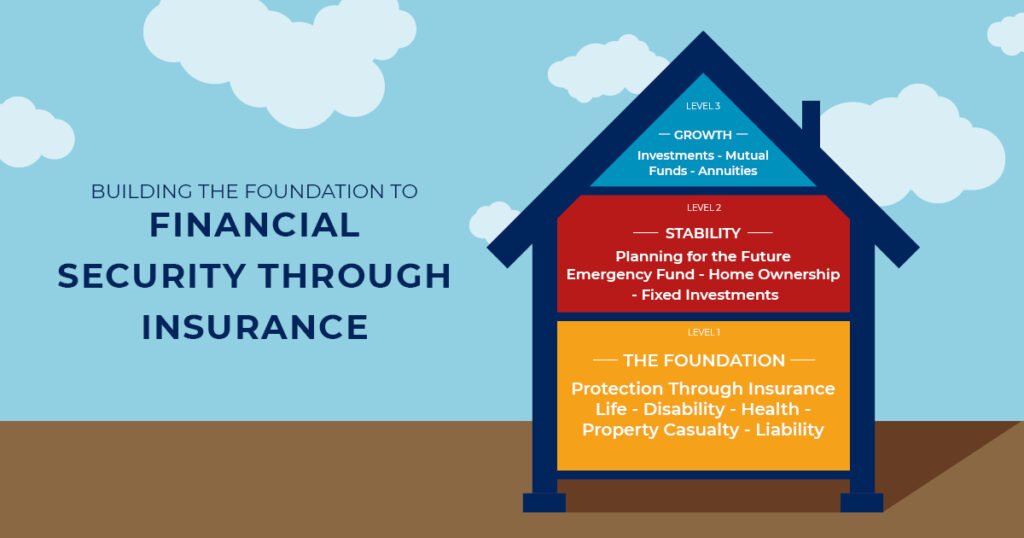

Insurance as a Tool for Financial Security

Insurance is more than just a formality — it’s a safety net that protects your personal finances from unexpected events. Health insurance, property insurance, and life insurance help reduce the financial burden of accidents, illness, or loss of income.

For example, a medical emergency without coverage can drain years of savings. With insurance, most of the costs are handled by the provider. Similarly, property insurance covers damage from fire, theft, or natural disasters, preventing large one-time expenses.

By paying regular premiums, you spread the risk over time and gain financial stability. Insurance doesn’t eliminate risks, but it ensures that when problems arise, they don’t become a financial catastrophe.