Top 3 Budgeting Apps to Track Your Daily Expenses

Keeping track of expenses is the first step toward financial discipline. Today, mobile apps can do this automatically by recording every transaction. Three of the most popular options are:

- Mint — syncs with your cards and bank accounts, categorizes spending, and shows how much goes to food, transport, or entertainment.

- YNAB (You Need A Budget) — helps plan spending in advance: every dollar is assigned to a specific purpose.

- PocketGuard — focuses on how much disposable income is left after fixed payments.

These apps save time and give a clear picture of where your money goes.

How to Set Financial Goals Using a Mobile App

Financial goals are easier to achieve when they are written down. Modern apps allow you to create “savings jars” for different purposes: a vacation, home renovation, or a new gadget. You simply enter the target amount and the deadline, and the app calculates how much to save weekly or monthly.

For example, to save $600 in six months, the app will suggest setting aside $100 per month. The goal appears in the dashboard, and progress updates with each deposit. Visual tracking like this keeps motivation and discipline high.

Step-by-Step: Connecting Your Bank Account to a Budget Tracker

To make a budgeting app more effective, it’s worth connecting your bank account. The process usually looks like this:

- Select your bank from the app’s list.

- Enter your online banking login details.

- Confirm access with a one-time security code.

- Allow automatic import of all transactions.

From then on, the app will update your spending data and sort transactions into categories. All you need to do is review the reports and adjust your budget.

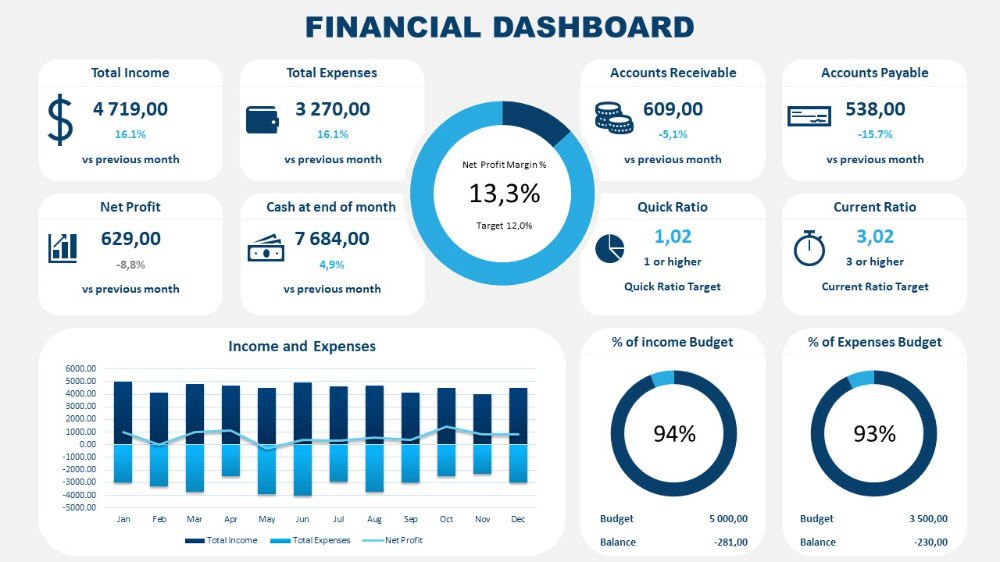

Top Financial Dashboards to See All Your Money in One Place

Managing money becomes easier when everything is visible on one screen. Financial dashboards bring together bank accounts, credit cards, loans, and even investments in a single app. Instead of checking multiple platforms, you get a complete snapshot of your finances at a glance.

Popular options include services like Personal Capital or Money Dashboard, which show balances, spending patterns, and progress toward savings goals. For anyone juggling several accounts, this “all-in-one” view helps track cash flow, reduce debt faster, and stay focused on long-term plans.

Best Apps for Beginners to Start Investing Safely

Getting started with investing can feel overwhelming, but beginner-friendly apps make the process simpler. Platforms like Robinhood, eToro, and Acorns allow users to buy stocks, ETFs, or even fractional shares with just a few clicks. Many of these apps also provide tutorials and built-in risk warnings.

For newcomers, the main advantage is accessibility: you don’t need a large starting capital, and you can experiment with small amounts. However, it’s important to treat these apps as a first step, not a full strategy. Responsible investing still requires planning and patience.

Automated Savings Tools: How to Save Without Thinking About It

Saving money often fails because it relies on willpower. Automated tools remove that barrier. Some apps round up every purchase and move the “spare change” into a savings account. Others allow you to schedule recurring transfers — for example, $20 every Friday.

Over time, these small, automatic deposits add up. You barely notice the process, but in a few months you’ll see a solid balance in your savings fund. The key is not to withdraw the money prematurely.

Robo-Advisors Explained: Are They Worth It for Your Portfolio?

Robo-advisors are digital platforms that manage investments using algorithms. After you answer a short questionnaire about your goals and risk tolerance, the system builds a portfolio of stocks, bonds, or ETFs and periodically rebalances it.

For beginners, robo-advisors are a convenient way to start investing without deep financial knowledge. The main downsides are management fees and the lack of human judgment in unusual market conditions. Still, for long-term, hands-off investors, they can be a valuable tool.