Secrets of the Wealthy: Lessons Worth Learning

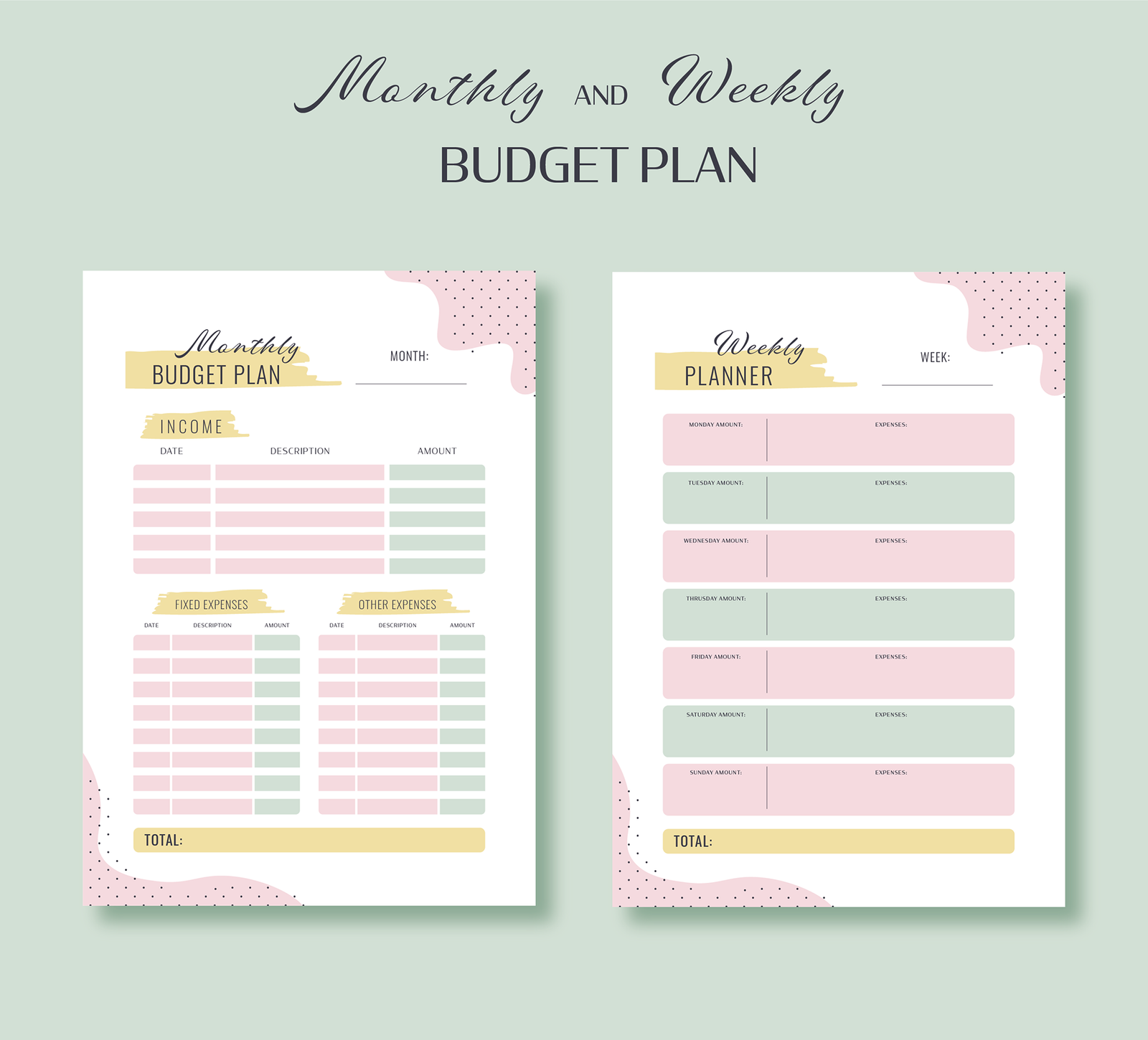

Wealth rarely comes by chance — it’s built on habits and a mindset toward money. One of the main principles is to save first and spend later. The wealthy always have a financial plan and review it regularly. Discipline also matters: investing consistently, even in small amounts, and not letting emotions drive decisions. They focus on building multiple income streams and commit to lifelong learning to stay aware of new opportunities. The most valuable lesson is their long-term perspective — making choices based on future goals rather than short-term desires.

General Heading

Balancing Myths, Choices, and Smart Investing

What Matters More: Earning More or Spending Less?

There’s no universal answer in financial literacy, but balance is always key. Earning more expands opportunities and helps you reach goals faster. However, if expenses grow at the same pace as income, the result is zero. On the other hand, cutting costs brings quick results but has its limits. The best approach is to combine both: seek ways to increase income while keeping expenses under control. This balance allows you to save, invest, and build financial stability without falling into extreme frugality.

Myths About Financial Literacy People Still Believe

There are many myths that prevent people from managing money effectively. One of the most common is the belief that saving is only possible with a high income. In reality, consistency and discipline matter more. Another myth is that investing is only for professionals. Today, modern tools let anyone start with very small amounts. It’s also a mistake to assume all credit is harmful — when used wisely, loans can become a tool for growth. Debunking these myths helps people build healthier financial habits.

Why It’s Important to Invest Even With a Small Income

Many postpone investing until “better times,” thinking it’s meaningless with a small income. In fact, an early start — even with small amounts — provides a huge advantage thanks to compound interest. Regular contributions build capital gradually, while diversification lowers risks. Investments also protect money from inflation and create a financial safety net for the future. The key is not to wait for the perfect moment but to begin with what you can. Small steps today can lead to significant results in the long run.

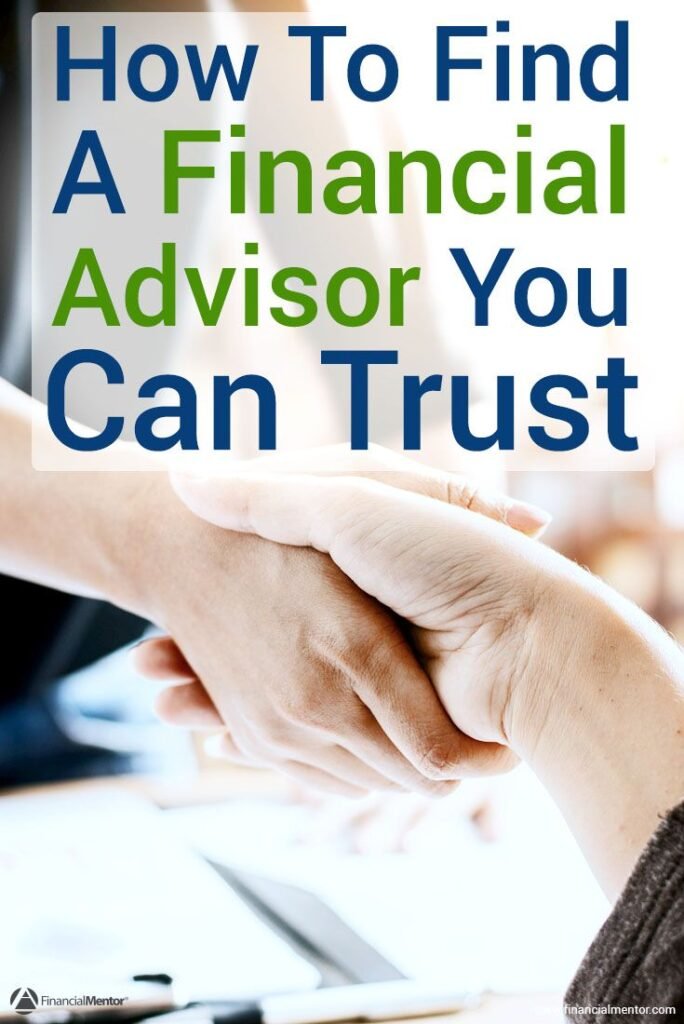

Should You Trust Financial Advisors?

Financial advisors can be helpful, especially when it comes to complex investments or planning major goals. They assist in assessing risks, selecting suitable tools, and building strategies. However, it’s important to remember that the quality of advice depends on the advisor’s competence and independence. Some earn commissions from selling financial products, which means their recommendations may not always be objective. Before working with an advisor, check their experience, reputation, and terms of service. An advisor can be a reliable guide, but final decisions should always be based on your own knowledge and personal goals.

Inflation: How to Protect Your Money and Preserve Savings

Inflation gradually reduces the purchasing power of money: what you can buy today may cost more tomorrow. To protect savings, it’s important not to keep everything in cash or in a basic account with no interest. One option is to use deposits or bonds that yield returns higher than the inflation rate. Long-term strategies include investing in index funds, real estate, or a diversified portfolio of assets. Spreading savings across different instruments is also useful. Smart management helps preserve the real value of money and safeguard it from devaluation.